Page 22 - GA Maclachlan Tax Guide 2024

P. 22

TRUSTS

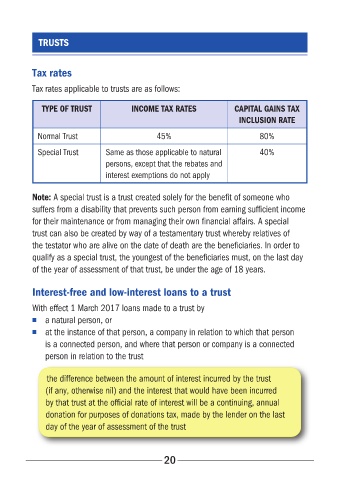

Tax rates

Tax rates applicable to trusts are as follows:

TYPE OF TRUST INCOME TAX RATES CAPITAL GAINS TAX

INCLUSION RATE

Normal Trust 45% 80%

Special Trust Same as those applicable to natural 40%

persons, except that the rebates and

interest exemptions do not apply

Note: A special trust is a trust created solely for the benefit of someone who

suffers from a disability that prevents such person from earning sufficient income

for their maintenance or from managing their own financial affairs� A special

trust can also be created by way of a testamentary trust whereby relatives of

the testator who are alive on the date of death are the beneficiaries� In order to

qualify as a special trust, the youngest of the beneficiaries must, on the last day

of the year of assessment of that trust, be under the age of 18 years�

Interest-free and low-interest loans to a trust

With effect 1 March 2017 loans made to a trust by

■ a natural person, or

■ at the instance of that person, a company in relation to which that person

is a connected person, and where that person or company is a connected

person in relation to the trust

the difference between the amount of interest incurred by the trust

(if any, otherwise nil) and the interest that would have been incurred

by that trust at the official rate of interest will be a continuing, annual

donation for purposes of donations tax, made by the lender on the last

day of the year of assessment of the trust

20