Page 26 - GA Maclachlan Tax Guide 2024

P. 26

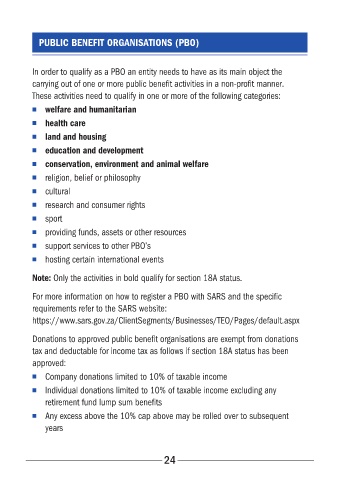

PUBLIC BENEFIT ORGANISATIONS (PBO)

In order to qualify as a PBO an entity needs to have as its main object the

carrying out of one or more public benefit activities in a non-profit manner�

These activities need to qualify in one or more of the following categories:

■ welfare and humanitarian

■ health care

■ land and housing

■ education and development

■ conservation, environment and animal welfare

■ religion, belief or philosophy

■ cultural

■ research and consumer rights

■ sport

■ providing funds, assets or other resources

■ support services to other PBO’s

■ hosting certain international events

Note: Only the activities in bold qualify for section 18A status�

For more information on how to register a PBO with SARS and the specific

requirements refer to the SARS website:

https://www�sars�gov�za/ClientSegments/Businesses/TEO/Pages/default�aspx

Donations to approved public benefit organisations are exempt from donations

tax and deductable for income tax as follows if section 18A status has been

approved:

■ Company donations limited to 10% of taxable income

■ Individual donations limited to 10% of taxable income excluding any

retirement fund lump sum benefits

■ Any excess above the 10% cap above may be rolled over to subsequent

years

24