Page 25 - GA Maclachlan Tax Guide 2024

P. 25

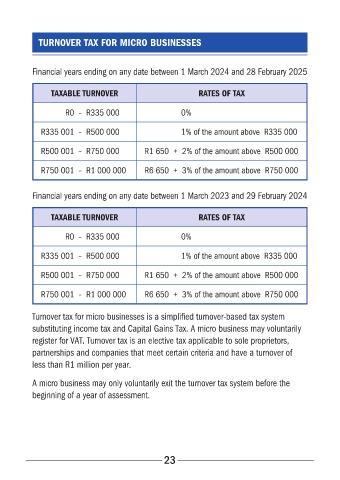

TURNOVER TAX FOR MICRO BUSINESSES

Financial years ending on any date between 1 March 2024 and 28 February 2025

TAXABLE TURNOVER RATES OF TAX

R0 – R335 000 0%

R335 001 – R500 000 1% of the amount above R335 000

R500 001 – R750 000 R1 650 + 2% of the amount above R500 000

R750 001 – R1 000 000 R6 650 + 3% of the amount above R750 000

Financial years ending on any date between 1 March 2023 and 29 February 2024

TAXABLE TURNOVER RATES OF TAX

R0 – R335 000 0%

R335 001 – R500 000 1% of the amount above R335 000

R500 001 – R750 000 R1 650 + 2% of the amount above R500 000

R750 001 – R1 000 000 R6 650 + 3% of the amount above R750 000

Turnover tax for micro businesses is a simplified turnover-based tax system

substituting income tax and Capital Gains Tax� A micro business may voluntarily

register for VAT� Turnover tax is an elective tax applicable to sole proprietors,

partnerships and companies that meet certain criteria and have a turnover of

less than R1 million per year�

A micro business may only voluntarily exit the turnover tax system before the

beginning of a year of assessment�

23