Page 20 - GA Maclachlan Tax Guide 2024

P. 20

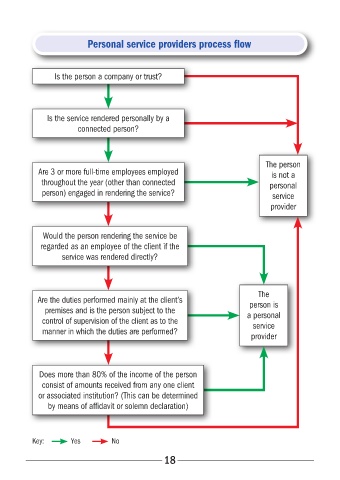

Personal service providers process flow

Is the person a company or trust?

Is the service rendered personally by a

connected person?

The person

Are 3 or more full-time employees employed is not a

throughout the year (other than connected personal

person) engaged in rendering the service? service

provider

Would the person rendering the service be

regarded as an employee of the client if the

service was rendered directly?

The

Are the duties performed mainly at the client’s person is

premises and is the person subject to the a personal

control of supervision of the client as to the service

manner in which the duties are performed?

provider

Does more than 80% of the income of the person

consist of amounts received from any one client

or associated institution? (This can be determined

by means of affidavit or solemn declaration)

Key: Yes No

18