Page 17 - GA Maclachlan Tax Guide 2024

P. 17

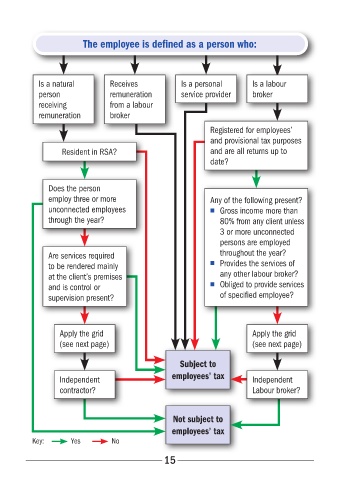

The employee is defined as a person who:

Is a natural Receives Is a personal Is a labour

person remuneration service provider broker

receiving from a labour

remuneration broker

Registered for employees’

and provisional tax purposes

Resident in RSA? and are all returns up to

date?

Does the person

employ three or more Any of the following present?

unconnected employees ■ Gross income more than

through the year? 80% from any client unless

3 or more unconnected

persons are employed

Are services required throughout the year?

to be rendered mainly ■ Provides the services of

at the client’s premises any other labour broker?

and is control or ■ Obliged to provide services

supervision present? of specified employee?

Apply the grid Apply the grid

(see next page) (see next page)

Subject to

Independent employees’ tax Independent

contractor? Labour broker?

Not subject to

employees’ tax

Key: Yes No

15