Page 14 - GA Maclachlan Tax Guide 2024

P. 14

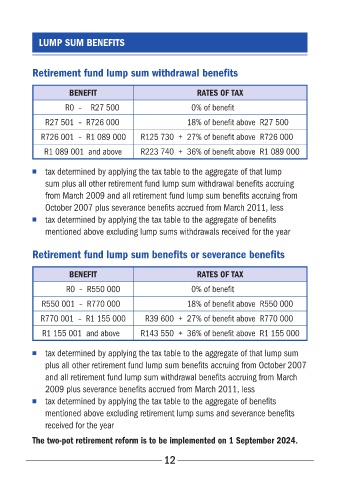

LUMP SUM BENEFITS

Retirement fund lump sum withdrawal benefits

BENEFIT RATES OF TAX

R0 – R27 500 0% of benefit

R27 501 – R726 000 18% of benefit above R27 500

R726 001 – R1 089 000 R125 730 + 27% of benefit above R726 000

R1 089 001 and above R223 740 + 36% of benefit above R1 089 000

■ tax determined by applying the tax table to the aggregate of that lump

sum plus all other retirement fund lump sum withdrawal benefits accruing

from March 2009 and all retirement fund lump sum benefits accruing from

October 2007 plus severance benefits accrued from March 2011, less

■ tax determined by applying the tax table to the aggregate of benefits

mentioned above excluding lump sums withdrawals received for the year

Retirement fund lump sum benefits or severance benefits

BENEFIT RATES OF TAX

R0 – R550 000 0% of benefit

R550 001 – R770 000 18% of benefit above R550 000

R770 001 – R1 155 000 R39 600 + 27% of benefit above R770 000

R1 155 001 and above R143 550 + 36% of benefit above R1 155 000

■ tax determined by applying the tax table to the aggregate of that lump sum

plus all other retirement fund lump sum benefits accruing from October 2007

and all retirement fund lump sum withdrawal benefits accruing from March

2009 plus severance benefits accrued from March 2011, less

■ tax determined by applying the tax table to the aggregate of benefits

mentioned above excluding retirement lump sums and severance benefits

received for the year

The two-pot retirement reform is to be implemented on 1 September 2024.

12