Page 60 - GA Maclachlan Tax Guide 2024

P. 60

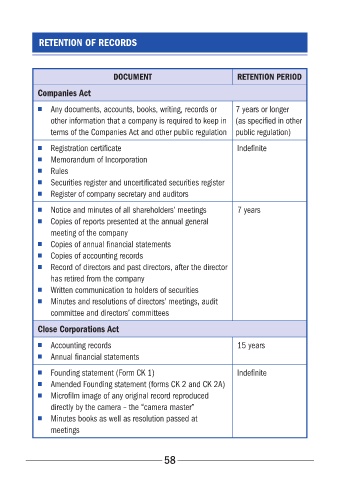

RETENTION OF RECORDS

DOCUMENT RETENTION PERIOD

Companies Act

■ Any documents, accounts, books, writing, records or 7 years or longer

other information that a company is required to keep in (as specified in other

terms of the Companies Act and other public regulation public regulation)

■ Registration certificate Indefinite

■ Memorandum of Incorporation

■ Rules

■ Securities register and uncertificated securities register

■ Register of company secretary and auditors

■ Notice and minutes of all shareholders’ meetings 7 years

■ Copies of reports presented at the annual general

meeting of the company

■ Copies of annual financial statements

■ Copies of accounting records

■ Record of directors and past directors, after the director

has retired from the company

■ Written communication to holders of securities

■ Minutes and resolutions of directors’ meetings, audit

committee and directors’ committees

Close Corporations Act

■ Accounting records 15 years

■ Annual financial statements

■ Founding statement (Form CK 1) Indefinite

■ Amended Founding statement (forms CK 2 and CK 2A)

■ Microfilm image of any original record reproduced

directly by the camera – the “camera master”

■ Minutes books as well as resolution passed at

meetings

58