Page 57 - GA Maclachlan Tax Guide 2024

P. 57

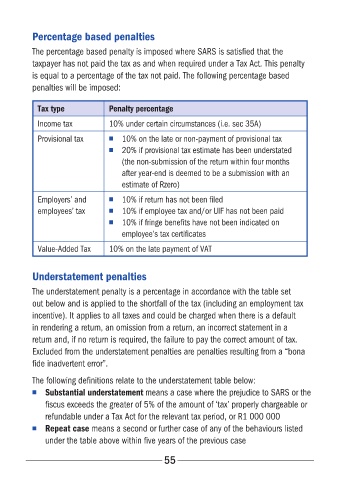

Percentage based penalties

The percentage based penalty is imposed where SARS is satisfied that the

taxpayer has not paid the tax as and when required under a Tax Act� This penalty

is equal to a percentage of the tax not paid� The following percentage based

penalties will be imposed:

Tax type Penalty percentage

Income tax 10% under certain circumstances (i�e� sec 35A)

Provisional tax ■ 10% on the late or non-payment of provisional tax

■ 20% if provisional tax estimate has been understated

(the non-submission of the return within four months

after year-end is deemed to be a submission with an

estimate of Rzero)

Employers’ and ■ 10% if return has not been filed

employees’ tax ■ 10% if employee tax and/or UIF has not been paid

■ 10% if fringe benefits have not been indicated on

employee’s tax certificates

Value-Added Tax 10% on the late payment of VAT

Understatement penalties

The understatement penalty is a percentage in accordance with the table set

out below and is applied to the shortfall of the tax (including an employment tax

incentive)� It applies to all taxes and could be charged when there is a default

in rendering a return, an omission from a return, an incorrect statement in a

return and, if no return is required, the failure to pay the correct amount of tax�

Excluded from the understatement penalties are penalties resulting from a “bona

fide inadvertent error”�

The following definitions relate to the understatement table below:

■ Substantial understatement means a case where the prejudice to SARS or the

fiscus exceeds the greater of 5% of the amount of ‘tax’ properly chargeable or

refundable under a Tax Act for the relevant tax period, or R1 000 000

■ Repeat case means a second or further case of any of the behaviours listed

under the table above within five years of the previous case

55