Page 55 - GA Maclachlan Tax Guide 2024

P. 55

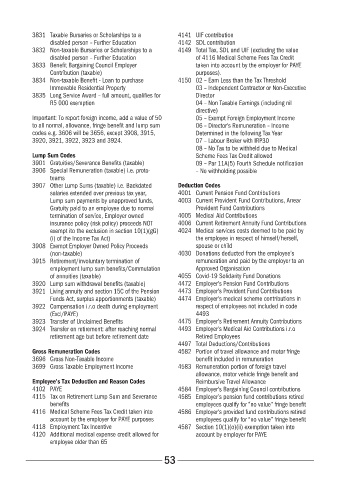

3831 Taxable Bursaries or Scholarships to a 4141 UIF contribution

disabled person – Further Education 4142 SDL contribution

3832 Non-taxable Bursaries or Scholarships to a 4149 Total Tax, SDL and UIF (excluding the value

disabled person – Further Education of 4116 Medical Scheme Fees Tax Credit

3833 Benefit Bargaining Council Employer taken into account by the employer for PAYE

Contribution (taxable) purposes)�

3834 Non-taxable Benefit - Loan to purchase 4150 02 – Earn Less than the Tax Threshold

Immovable Residential Property 03 – Independent Contractor or Non-Executive

3835 Long Service Award – full amount, qualifies for Director

R5 000 exemption 04 – Non Taxable Earnings (including nil

directive)

Important: To report foreign income, add a value of 50 05 – Exempt Foreign Employment Income

to all normal, allowance, fringe benefit and lump sum 06 – Director’s Remuneration – Income

codes e�g� 3606 will be 3656, except 3908, 3915, Determined in the following Tax Year

3920, 3921, 3922, 3923 and 3924� 07 – Labour Broker with IRP30

08 – No Tax to be withheld due to Medical

Lump Sum Codes Scheme Fees Tax Credit allowed

3901 Gratuities/Severance Benefits (taxable) 09 – Par 11A(5) Fourth Schedule notification

3906 Special Remuneration (taxable) i�e� proto- – No withholding possible

teams

3907 Other Lump Sums (taxable) i�e� Backdated Deduction Codes

salaries extended over previous tax year, 4001 Current Pension Fund Contributions

Lump sum payments by unapproved funds, 4003 Current Provident Fund Contributions, Arrear

Gratuity paid to an employee due to normal Provident Fund Contributions

termination of service, Employer owned 4005 Medical Aid Contributions

insurance policy (risk policy) proceeds NOT 4006 Current Retirement Annuity Fund Contributions

exempt ito the exclusion in section 10(1)(gG) 4024 Medical services costs deemed to be paid by

(i) of the Income Tax Act) the employee in respect of himself/herself,

3908 Exempt Employer Owned Policy Proceeds spouse or child

(non-taxable) 4030 Donations deducted from the employee’s

3915 Retirement/involuntary termination of remuneration and paid by the employer to an

employment lump sum benefits/Commutation Approved Organisation

of annuities (taxable) 4055 Covid-19 Solidarity Fund Donations

3920 Lump sum withdrawal benefits (taxable) 4472 Employer's Pension Fund Contributions

3921 Living annuity and section 15C of the Pension 4473 Employer's Provident Fund Contributions

Funds Act, surplus apportionments (taxable) 4474 Employer’s medical scheme contributions in

3922 Compensation i�r�o death during employment respect of employees not included in code

(Excl/PAYE) 4493

3923 Transfer of Unclaimed Benefits 4475 Employer's Retirement Annuity Contributions

3924 Transfer on retirement: after reaching normal 4493 Employer’s Medical Aid Contributions i�r�o

retirement age but before retirement date Retired Employees

4497 Total Deductions/Contributions

Gross Remuneration Codes 4582 Portion of travel allowance and motor fringe

3696 Gross Non-Taxable Income benefit included in remuneration

3699 Gross Taxable Employment Income 4583 Remuneration portion of foreign travel

allowance, motor vehicle fringe benefit and

Employee’s Tax Deduction and Reason Codes Reimbursive Travel Allowance

4102 PAYE 4584 Employer's Bargaining Council contributions

4115 Tax on Retirement Lump Sum and Severance 4585 Employer’s pension fund contributions retired

benefits employees qualify for “no value” fringe benefit

4116 Medical Scheme Fees Tax Credit taken into 4586 Employer’s provided fund contributions retired

account by the employer for PAYE purposes employees qualify for “no value” fringe benefit

4118 Employment Tax Incentive 4587 Section 10(1)(o)(ii) exemption taken into

4120 Additional medical expense credit allowed for account by employer for PAYE

employee older than 65

53