Page 51 - GA Maclachlan Tax Guide 2024

P. 51

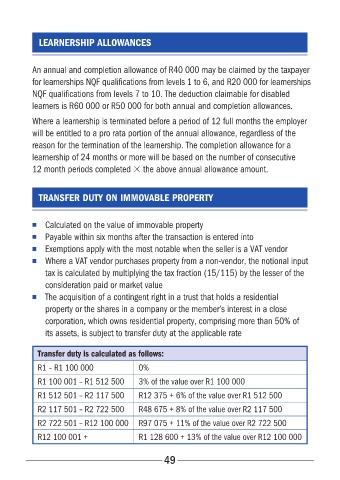

LEARNERSHIP ALLOWANCES

An annual and completion allowance of R40 000 may be claimed by the taxpayer

for learnerships NQF qualifications from levels 1 to 6, and R20 000 for learnerships

NQF qualifications from levels 7 to 10� The deduction claimable for disabled

learners is R60 000 or R50 000 for both annual and completion allowances�

Where a learnership is terminated before a period of 12 full months the employer

will be entitled to a pro rata portion of the annual allowance, regardless of the

reason for the termination of the learnership� The completion allowance for a

learnership of 24 months or more will be based on the number of consecutive

12 month periods completed × the above annual allowance amount�

TRANSFER DUTY ON IMMOVABLE PROPERTY

■ Calculated on the value of immovable property

■ Payable within six months after the transaction is entered into

■ Exemptions apply with the most notable when the seller is a VAT vendor

■ Where a VAT vendor purchases property from a non-vendor, the notional input

tax is calculated by multiplying the tax fraction (15/115) by the lesser of the

consideration paid or market value

■ The acquisition of a contingent right in a trust that holds a residential

property or the shares in a company or the member’s interest in a close

corporation, which owns residential property, comprising more than 50% of

its assets, is subject to transfer duty at the applicable rate

Transfer duty is calculated as follows:

R1 – R1 100 000 0%

R1 100 001 – R1 512 500 3% of the value over R1 100 000

R1 512 501 – R2 117 500 R12 375 + 6% of the value over R1 512 500

R2 117 501 – R2 722 500 R48 675 + 8% of the value over R2 117 500

R2 722 501 – R12 100 000 R97 075 + 11% of the value over R2 722 500

R12 100 001 + R1 128 600 + 13% of the value over R12 100 000

49