Page 54 - GA Maclachlan Tax Guide 2024

P. 54

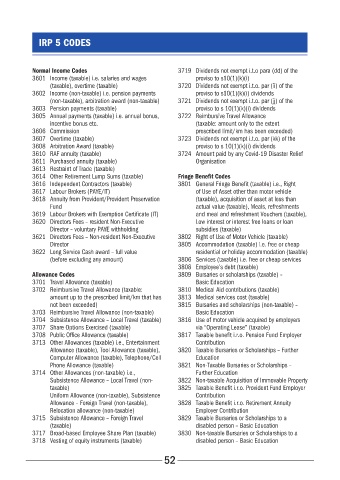

IRP 5 CODES

Normal Income Codes 3719 Dividends not exempt i�t�o para (dd) of the

3601 Income (taxable) i�e� salaries and wages proviso to s10(1)(k)(i)

(taxable), overtime (taxable) 3720 Dividends not exempt i�t�o� par (ii) of the

3602 Income (non-taxable) i�e� pension payments proviso to s10(1)(k)(i) dividends

(non-taxable), arbitration award (non-taxable) 3721 Dividends not exempt i�t�o� par (jj) of the

3603 Pension payments (taxable) proviso to s 10(1)(k)(i) dividends

3605 Annual payments (taxable) i�e� annual bonus, 3722 Reimbursive Travel Allowance

incentive bonus etc� (taxable: amount only to the extent

3606 Commission prescribed limit/km has been exceeded)

3607 Overtime (taxable) 3723 Dividends not exempt i�t�o� par (kk) of the

3608 Arbitration Award (taxable) proviso to s 10(1)(k)(i) dividends

3610 RAF annuity (taxable) 3724 Amount paid by any Covid-19 Disaster Relief

3611 Purchased annuity (taxable) Organisation

3613 Restraint of Trade (taxable)

3614 Other Retirement Lump Sums (taxable) Fringe Benefit Codes

3616 Independent Contractors (taxable) 3801 General Fringe Benefit (taxable) i�e�, Right

3617 Labour Brokers (PAYE/IT) of Use of Asset other than motor vehicle

3618 Annuity from Provident/Provident Preservation (taxable), acquisition of asset at less than

Fund actual value (taxable), Meals, refreshments

3619 Labour Brokers with Exemption Certificate (IT) and meal and refreshment Vouchers (taxable),

3620 Directors Fees – resident Non-Executive Low interest or interest free loans or loan

Director – voluntary PAYE withholding subsidies (taxable)

3621 Directors Fees – Non-resident Non-Executive 3802 Right of Use of Motor Vehicle (taxable)

Director 3805 Accommodation (taxable) i�e� free or cheap

3622 Long Service Cash award – full value residential or holiday accommodation (taxable)

(before excluding any amount) 3806 Services (taxable) i�e� free or cheap services

3808 Employee’s debt (taxable)

Allowance Codes 3809 Bursaries or scholarships (taxable) –

3701 Travel Allowance (taxable) Basic Education

3702 Reimbursive Travel Allowance (taxable: 3810 Medical Aid contributions (taxable)

amount up to the prescribed limit /km that has 3813 Medical services cost (taxable)

not been exceeded) 3815 Bursaries and scholarships (non-taxable) –

3703 Reimbursive Travel Allowance (non-taxable) Basic Education

3704 Subsistence Allowance – Local Travel (taxable) 3816 Use of motor vehicle acquired by employers

3707 Share Options Exercised (taxable) via “Operating Lease” (taxable)

3708 Public Office Allowance (taxable) 3817 Taxable benefit i�r�o� Pension Fund Employer

3713 Other Allowances (taxable) i�e�, Entertainment Contribution

Allowance (taxable), Tool Allowance (taxable), 3820 Taxable Bursaries or Scholarships – Further

Computer Allowance (taxable), Telephone/Cell Education

Phone Allowance (taxable) 3821 Non-Taxable Bursaries or Scholarships –

3714 Other Allowances (non-taxable) i�e�, Further Education

Subsistence Allowance – Local Travel (non- 3822 Non-taxable Acquisition of Immovable Property

taxable) 3825 Taxable Benefit i�r�o� Provident Fund Employer

Uniform Allowance (non-taxable), Subsistence Contribution

Allowance – Foreign Travel (non-taxable), 3828 Taxable Benefit i�r�o� Retirement Annuity

Relocation allowance (non-taxable) Employer Contribution

3715 Subsistence Allowance – Foreign Travel 3829 Taxable Bursaries or Scholarships to a

(taxable) disabled person – Basic Education

3717 Broad-based Employee Share Plan (taxable) 3830 Non-taxable Bursaries or Scholarships to a

3718 Vesting of equity instruments (taxable) disabled person – Basic Education

52