Page 61 - GA Maclachlan Tax Guide 2024

P. 61

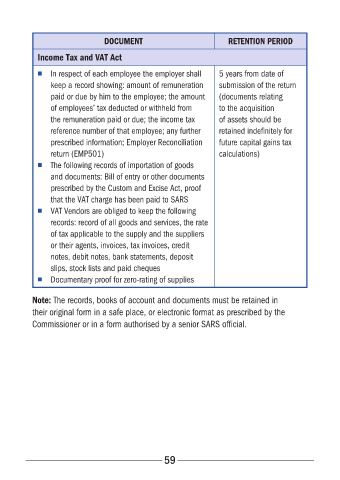

DOCUMENT RETENTION PERIOD

Income Tax and VAT Act

■ In respect of each employee the employer shall 5 years from date of

keep a record showing: amount of remuneration submission of the return

paid or due by him to the employee; the amount (documents relating

of employees’ tax deducted or withheld from to the acquisition

the remuneration paid or due; the income tax of assets should be

reference number of that employee; any further retained indefinitely for

prescribed information; Employer Reconciliation future capital gains tax

return (EMP501) calculations)

■ The following records of importation of goods

and documents: Bill of entry or other documents

prescribed by the Custom and Excise Act, proof

that the VAT charge has been paid to SARS

■ VAT Vendors are obliged to keep the following

records: record of all goods and services, the rate

of tax applicable to the supply and the suppliers

or their agents, invoices, tax invoices, credit

notes, debit notes, bank statements, deposit

slips, stock lists and paid cheques

■ Documentary proof for zero-rating of supplies

Note: The records, books of account and documents must be retained in

their original form in a safe place, or electronic format as prescribed by the

Commissioner or in a form authorised by a senior SARS official�

59