Page 8 - GA Maclachlan Tax Guide 2024

P. 8

FRINGE BENEFITS

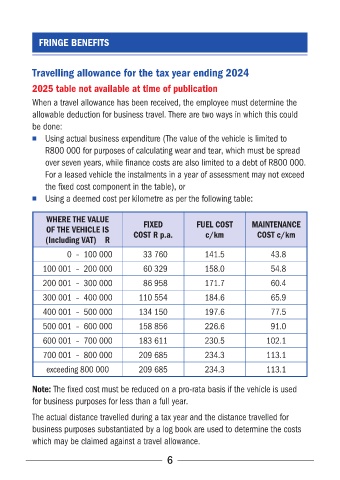

Travelling allowance for the tax year ending 2024

2025 table not available at time of publication

When a travel allowance has been received, the employee must determine the

allowable deduction for business travel� There are two ways in which this could

be done:

■ Using actual business expenditure (The value of the vehicle is limited to

R800 000 for purposes of calculating wear and tear, which must be spread

over seven years, while finance costs are also limited to a debt of R800 000�

For a leased vehicle the instalments in a year of assessment may not exceed

the fixed cost component in the table), or

■ Using a deemed cost per kilometre as per the following table:

WHERE THE VALUE

OF THE VEHICLE IS FIXED FUEL COST MAINTENANCE

(Including VAT) R COST R p.a. c/km COST c/km

0 – 100 000 33 760 141�5 43�8

100 001 – 200 000 60 329 158�0 54�8

200 001 – 300 000 86 958 171�7 60�4

300 001 – 400 000 110 554 184�6 65�9

400 001 – 500 000 134 150 197�6 77�5

500 001 – 600 000 158 856 226�6 91�0

600 001 – 700 000 183 611 230�5 102�1

700 001 – 800 000 209 685 234�3 113�1

exceeding 800 000 209 685 234�3 113�1

Note: The fixed cost must be reduced on a pro-rata basis if the vehicle is used

for business purposes for less than a full year�

The actual distance travelled during a tax year and the distance travelled for

business purposes substantiated by a log book are used to determine the costs

which may be claimed against a travel allowance�

6