Page 4 - GA Maclachlan Tax Guide 2024

P. 4

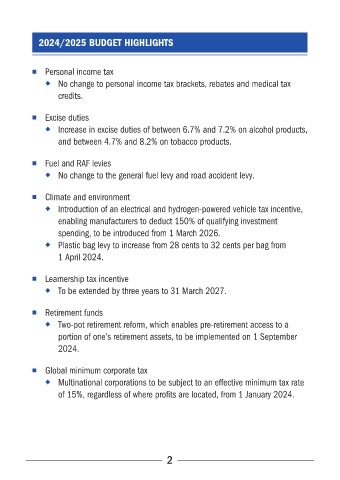

2024/2025 BUDGET HIGHLIGHTS

■ Personal income tax

◆ No change to personal income tax brackets, rebates and medical tax

credits�

■ Excise duties

◆ Increase in excise duties of between 6�7% and 7�2% on alcohol products,

and between 4�7% and 8�2% on tobacco products�

■ Fuel and RAF levies

◆ No change to the general fuel levy and road accident levy�

■ Climate and environment

◆ Introduction of an electrical and hydrogen-powered vehicle tax incentive,

enabling manufacturers to deduct 150% of qualifying investment

spending, to be introduced from 1 March 2026�

◆ Plastic bag levy to increase from 28 cents to 32 cents per bag from

1 April 2024�

■ Learnership tax incentive

◆ To be extended by three years to 31 March 2027�

■ Retirement funds

◆ Two-pot retirement reform, which enables pre-retirement access to a

portion of one’s retirement assets, to be implemented on 1 September

2024�

■ Global minimum corporate tax

◆ Multinational corporations to be subject to an effective minimum tax rate

of 15%, regardless of where profits are located, from 1 January 2024�

2