Page 32 - GA Maclachlan Tax Guide 2024

P. 32

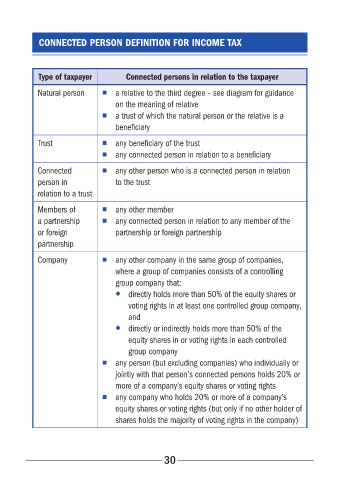

CONNECTED PERSON DEFINITION FOR INCOME TAX

Type of taxpayer Connected persons in relation to the taxpayer

Natural person ■ a relative to the third degree – see diagram for guidance

on the meaning of relative

■ a trust of which the natural person or the relative is a

beneficiary

Trust ■ any beneficiary of the trust

■ any connected person in relation to a beneficiary

Connected ■ any other person who is a connected person in relation

person in to the trust

relation to a trust

Members of ■ any other member

a partnership ■ any connected person in relation to any member of the

or foreign partnership or foreign partnership

partnership

Company ■ any other company in the same group of companies,

where a group of companies consists of a controlling

group company that:

◆ directly holds more than 50% of the equity shares or

voting rights in at least one controlled group company,

and

◆ directly or indirectly holds more than 50% of the

equity shares in or voting rights in each controlled

group company

■ any person (but excluding companies) who individually or

jointly with that person’s connected persons holds 20% or

more of a company’s equity shares or voting rights

■ any company who holds 20% or more of a company’s

equity shares or voting rights (but only if no other holder of

shares holds the majority of voting rights in the company)

30